Planning a successful event starts with a well-organized budget that ensures you stay on track financially. Whether you’re organizing a small gathering or a grand celebration, creating a clear event budget is crucial for managing expenses effectively.

In this blog post, we’ll take you through easy-to-follow steps to help you craft a simple yet comprehensive event budget, ensuring your event is not only a success but also profitable.

Table Of Contents

- What Is An Event Budget?

- Why Does Budget For Event Matter?

- 12 Steps To Create An Event Budget

- Key Takeaways

- FAQs

What is an Event Budget?

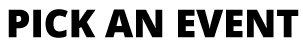

An event budget is like a money plan for an event and is a vital part of event planning. It lists all the costs and ways to get money for the event. This plan helps event planners, organizers, and others involved make sure the event doesn’t cost too much money.

Think of the budget as a map that shows where money should go for the event, a honeymoon or farewell party, for instance. This includes paying for the place where the event happens, food, advertising, decorations, entertainment, and more. It helps decide how much money should go to each part to make the event successful.

Budget lists typically include:

Income/Revenue Sources:

- Registration fees

- Sponsorships

- Ticket sales

- Grants

- Donations

Expenses:

- Venue rental and setup costs

- Catering and food

- Marketing and advertising

- Equipment and technology

- Speakers, performers, or entertainers

- Staffing and personnel

- Decorations and signage

- Miscellaneous expenses (printing, transportation, permits, etc.)

Why Does Budget For Event Matter?

- It ensures that expenses stay within reasonable limits and prevents overspending.

- It helps us see if the event is a good idea financially. We can figure out if we can really afford to do it.

- It helps prioritize which parts of the event are the most important. We can give more money to these parts to make sure they’re successful.

- It promotes transparency and accountability among the event team and stakeholders.

Read More:

- 17 Types Of Events

- The Ultimate Marketing Plan Handbook

- Event Management Tools

12 Steps to Create an Event Budget

Creating an event budget involves several steps to ensure all aspects of the event are considered and budgeted for appropriately. Here’s a detailed guide:

Step 1: Define Your Event Objectives:

Clearly outline the purpose, goals, and expected outcomes of the event. Understanding the event’s objectives will guide the budgeting process and help divide resources accordingly.

Step 2: List All Potential Expenses:

In event management, creating a comprehensive list of all the expenses you expect is useful and necessary. This includes:

- Venue costs,

- Catering,

- Entertainment,

- Decorations,

- Marketing,

- Staff,

- Permits,

- Insurance,

- Equipment rental,

- Any other potential costs

Step 3: Research and Gather Cost Estimates:

Research and gather detailed cost estimates for each expense item on your list. Reach out to vendors, suppliers, and service providers to get accurate pricing. It’s crucial to be as precise as possible in estimating costs.

If possible, negotiate with the suppliers to get the best possible pricing or added value. Clarify any discrepancies and ensure that the final pricing is agreed upon and documented in writing.

In addition, keep a record of all quotes and proposals received. Store them in an organized manner for future reference and as supporting documents for the budget.

Step 4: Categorize Expenses:

Organize the expenses into logical categories such as venue, promotion, operations, staffing, etc. This categorization helps in better tracking and management of the budget.

Step 5: Allocate Funds to Each Category:

Allocate a specific budget to each expense category based on your research and estimated costs. Be realistic and ensure the total budget allocation does not exceed your overall budget limit.

Step 6: Account for Contingencies:

Set aside a contingency fund or allocate a small percentage of the total budget for unexpected or unforeseen expenses that might arise during the planning and execution of the event.

- For example, decide on a percentage of the total budget to allocate as the contingency fund. Common percentages range from 5% to 15%, depending on the event’s complexity, scale, and level of uncertainty.

Step 7: Identify Potential Revenue Sources:

List down all potential revenue sources for the event, such as ticket sales, sponsorships, exhibitor fees, donations, or grants. Estimate the expected revenue from each source realistically.

Step 8: Calculate Projected Revenue:

Estimate how much revenue you think you’ll get from each way you plan to make money. This could be from selling tickets, getting sponsors, or any other ways you plan to bring in cash. Use your pricing plan and predictions for ticket sales to figure this out.

Step 9: Balance Expenses and Revenue:

Compare the total projected expenses against the total projected revenue. Ensure that the total expenses are within the range of the expected revenue to maintain a balanced budget.

Step 10: Adjust and Fine-Tune the Budget:

If there’s a deficit between projected expenses and revenue, review the budget and make necessary adjustments. Prioritize spending on essential aspects of the event and look for areas where you can reduce costs without compromising the event’s quality.

- For example, you can use decorations from previous events or create using cost-effective materials.

Step 11: Document and Finalize the Budget:

Document all budget details in a clear and organized format, such as a spreadsheet or budgeting tool. Ensure that all stakeholders involved in the event have access to and understand the finalized budget.

Step 12: Regularly Monitor and Update the Budget:

Throughout the event planning and execution process, monitor actual expenses and revenue against the budget. Make adjustments as needed and keep all stakeholders informed of any significant changes.

By following these steps and being careful in budget planning and management, you can ensure that your event stays on track financially and achieves its objectives within the budget.

Key Takeaways

Creating and managing an event budget is like having a roadmap for your event’s finances. It helps you plan how much you’ll spend and where that money will go. Making a budget is super important to make sure you don’t run out of money, and your event turns out just the way you want it.

And if you want your event to be even more exciting and fun, you can use a cool tool called AhaSlides. It’s like adding extra sparkle to your event! Its templates and interactive features can help you make your event engaging and interactive, keeping everyone involved and entertained. So, not only can you manage your money well, but you can also make your event unforgettable with a little help from technology!

More tips and advice about events? Pick an event that you’re concerned with, and we’ll help you!

FAQs

What is a comprehensive event budget?

A comprehensive event budget is a detailed plan showing all expected expenses and revenue for an event. It covers all costs and income to provide a clear financial picture.

What should be included in an event budget?

Include venue costs, catering, marketing, entertainment, staffing, permits, decorations, and miscellaneous expenses. Also, revenue sources like ticket sales, sponsorships, and donations should be considered.

How important is budgeting for an event?

An event budget matters because it keeps expenses in check, preventing overspending. It helps evaluate if the event is financially feasible and aligns with our resources. Additionally, it allows us to allocate funds to the most crucial aspects of the event, ensuring their success. Lastly, it fosters transparency and accountability within the event team and stakeholders.

What is the most important thing to remember when making an event budget?

Always track actual expenses and compare them to the budget to stay on course and make adjustments if needed.